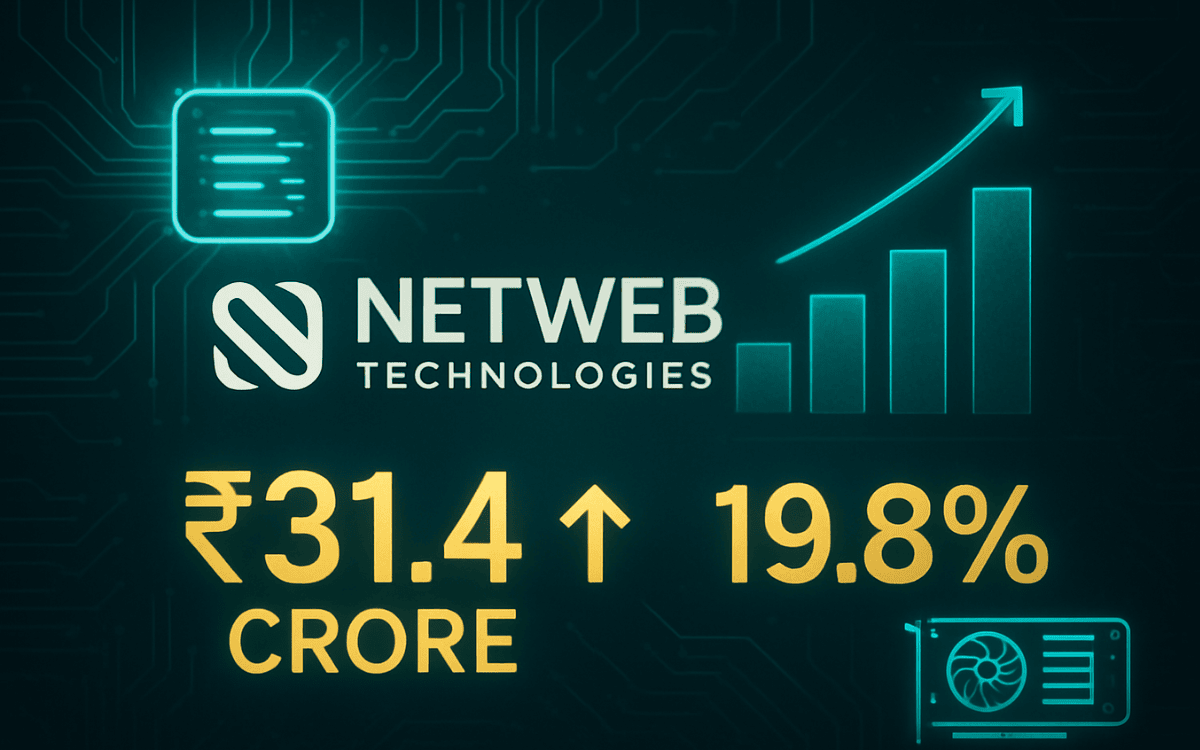

India’s tech-hardware sector is witnessing a strong turnaround, with Netweb Technologies posting a marked increase in profit for the quarter ended September 2025. The company reported a net profit of ₹31.4 crore, up 19.8 % from ₹26.2 crore in the year-ago period. The Economic Times

Revenue from operations also surged to ₹303.7 crore, compared with ₹251.0 crore a year earlier — a healthy growth rate of 20.9 %. On a sequential basis, profit rose 3.2 %, while revenue ticked up 0.8 %. The Economic Times

🔍 What’s Driving the Growth?

Netweb’s chairman and MD, Sanjay Lodha, revealed that the company secured two major strategic orders worth approximately ₹2,184 crore (Rs 21,840 million), slated for execution by FY 27. These orders are aimed at strengthening India’s AI compute infrastructure and advancing its sovereign AI ambitions. The Economic Times

The company offers a full stack of high-end computing solutions catering to IT/ITES, BFSI, national data centres, defence, education and R&D institutions. This diversified portfolio positions Netweb well as demand for on-premise and hyperscale data-center hardware ramps up. The Economic Times

📊 Financial Health & Outlook

While the topline growth is commendable, analysts will closely watch whether Netweb can sustain order wins and margin expansion. The lead times and execution risks associated with large-scale strategic deals can weigh on near-term cash flow, even as order books build.

That said, Netweb’s position as a domestic OEM for high-end compute solutions in India gives it a structural advantage — especially amid a push for reducing dependency on foreign hardware and building local infrastructure for AI and data-centres.

💡 Investor Takeaways

For investors, the quarter serves as a positive signal: rising growth, strong order intake and a business aligned with high-growth secular themes such as AI, cloud and data infrastructure. However, the current valuation may already reflect much of this future potential — hence, discipline and timing remain key.

Market watchers say that while Netweb’s recent performance lends credibility, the next challenge will be order conversion, delivery timelines, and maintaining margin discipline.

In short, Netweb Technologies enters this cycle with momentum on its side. Its improved financials and robust order book are compelling, but execution will determine whether this breakout can be sustained.