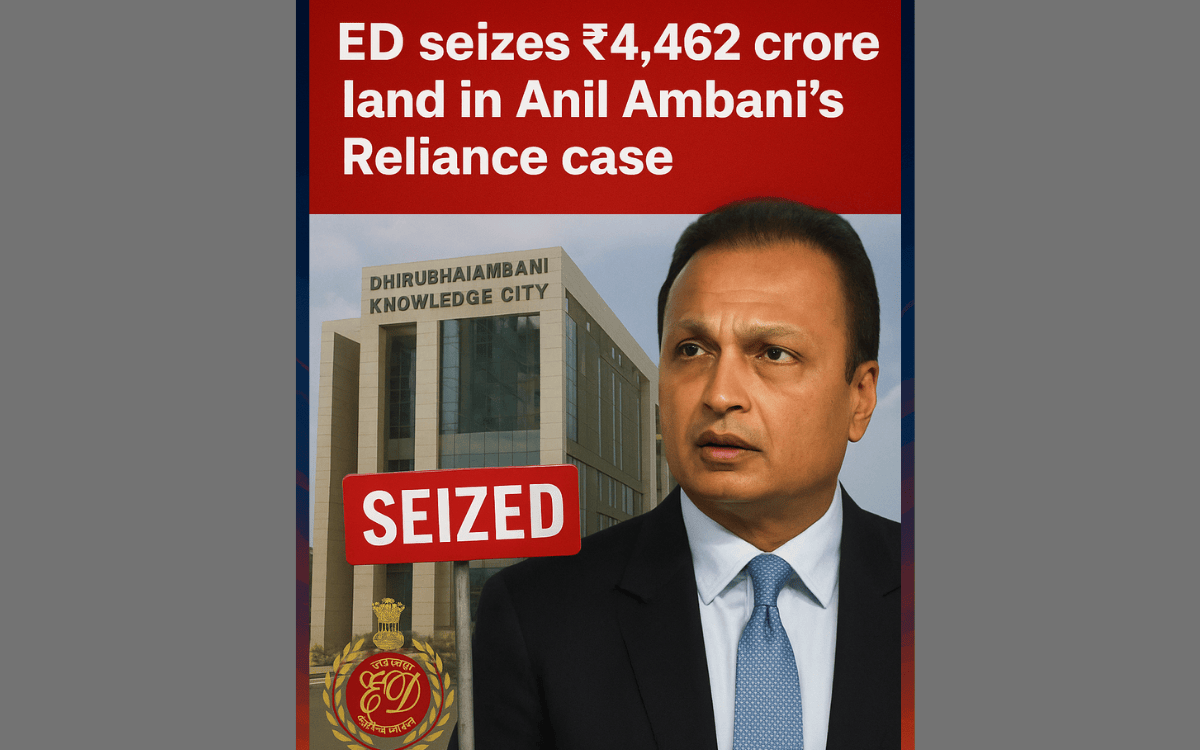

ED Cracks Down on Anil Ambani: ₹4,462 Crore DAKC Land Seized in Massive Reliance Probe

In a major blow to industrialist Anil Ambani, the Enforcement Directorate (ED) has seized over 132 acres of prime land inside the Dhirubhai Ambani Knowledge City (DAKC) in Navi Mumbai, valued at a staggering ₹4,462.81 crore. This marks a significant escalation in the bank fraud investigation against the Reliance Anil Dhirubhai Ambani Group (ADAG).

With this latest action, the total value of assets attached in connection with the ongoing Reliance Group loan fraud probe has now exceeded ₹7,500 crore, according to sources familiar with the matter.

🔍 ED Tightens the Net Under PMLA

The attachment was executed by the Directorate of Enforcement’s Special Task Force under the Prevention of Money Laundering Act (PMLA), 2002. The move follows continuing investigations into alleged diversion and misuse of bank loans by Reliance Communications (RCom) and other ADAG entities.

Earlier, the ED had already attached 42 properties worth ₹3,083 crore, connected to RCom, Reliance Commercial Finance Ltd, and Reliance Home Finance Ltd.

The probe stems from a CBI FIR filed under Sections 120-B, 406, and 420 of the IPC and the Prevention of Corruption Act, naming Anil Ambani and other key executives.

💰 Massive Loan Diversion Exposed

Investigations reveal that between 2010 and 2012, RCom and its group firms borrowed over ₹40,000 crore from domestic and foreign lenders. Shockingly, five banks later declared these accounts fraudulent.

The ED alleges that loans from one lender were used to repay debts of other group entities, or routed to related parties — violating lending conditions. Funds were even invested in mutual funds and fixed deposits, before being rerouted back into group companies.

According to ED findings, over ₹13,600 crore was diverted for “evergreening loans,” ₹12,600 crore went to related entities, and ₹1,800 crore was parked in financial instruments before being siphoned back into the group’s ecosystem.

🏦 Yes Bank–Reliance Link Under the Scanner

The ED also uncovered questionable financial links between Yes Bank and Reliance finance companies. Between 2017 and 2019, Yes Bank invested over ₹5,000 crore in Reliance Home Finance and Reliance Commercial Finance, which later turned into bad loans.

Investigators believe these investments were used to bypass SEBI conflict-of-interest rules, indirectly channeling public funds into Anil Ambani Group firms via mutual fund routes.

Both the ED and CBI allege that former Yes Bank CEO Rana Kapoor and Anil Ambani were part of a conspiracy that caused losses exceeding ₹2,700 crore to the bank.

⚖️ ED’s Final Word

The agency has flagged systemic control failures, alleging that large loans were approved in a single day, often without documentation or collateral. The ED stated that these lapses were “intentional,” and it remains determined to trace and recover all proceeds of crime in the Reliance fraud case.