Meta Platforms stunned the tech world by announcing a massive $14.3 billion investment in the startup Scale AI, and in the process poached its founder, Alexandr Wang. Forbes+3AP News+3The Verge+3 The move sparked major speculation: Was Scale AI on its way out? Had it effectively been absorbed into Meta’s AI ambitions? The Times of India

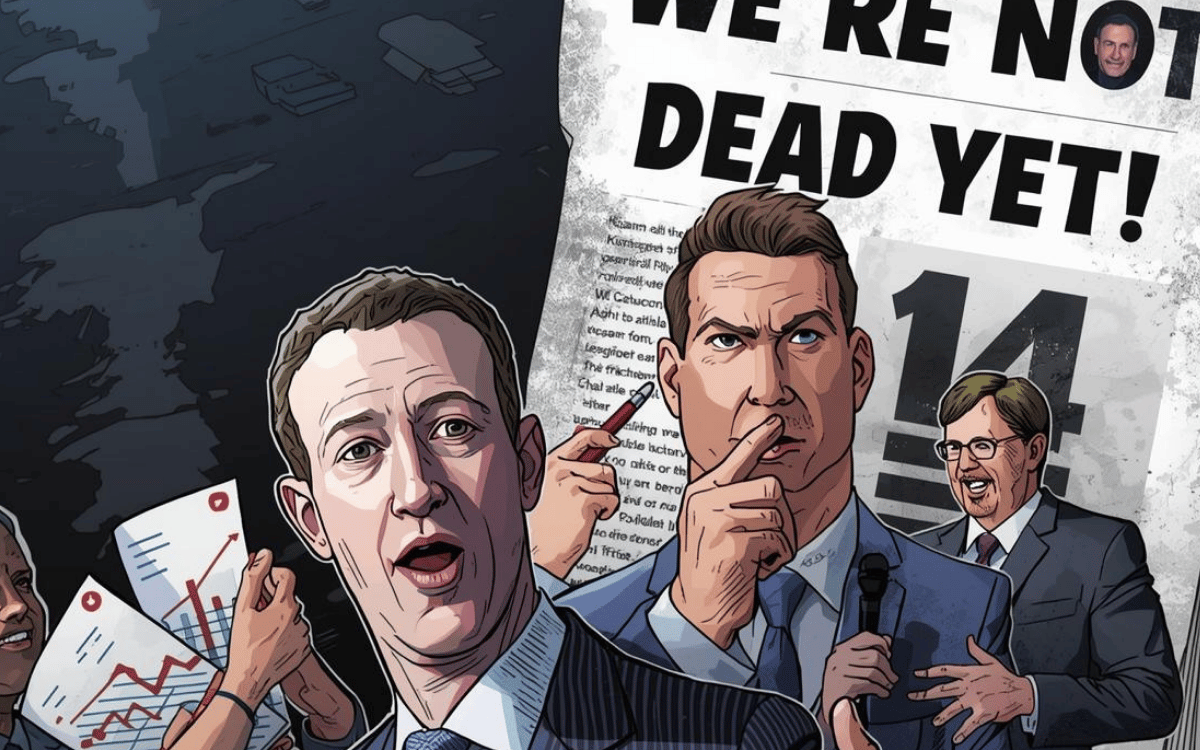

Fast forward five months, and Scale AI’s CFO, Dennis Cinelli, is publicly stepping in to clear the air — and push back against the idea that the startup is a “zombie company”. According to his comments in a recent interview, the business is very much alive, scoring major deals and doubling down on growth. The Times of India

What triggered the uproar

When Meta announced it would acquire a 49 % stake in Scale AI, many of the startup’s top executives, including its founder Alexandr Wang, shifted over to Meta’s AI team. AP News+1 At the same time, several of Scale’s major clients, including OpenAI, Google DeepMind and xAI, reportedly put their projects with Scale on pause — fuelling rumours the company was being sidelined. The Times of India

What the CFO had to say

Dennis Cinelli clarified that despite the changes, Scale AI remains independent, operational and actively securing business. He revealed the company recently signed some of its largest contracts ever — including major government work — and reported that the applications business has doubled in the second half of 2025. The Times of India He dismissed the idea that the Meta investment equated to a full buy-out or acqui-hire: “We’re not a zombie company,” he said. The Times of India

Why this matters

- Confidence signal: For investors and employees alike, positive updates from the CFO help reassure that the business hasn’t stalled just because the founder moved on.

- Talent & independence: The narrative that a startup loses relevance after key people leave isn’t always true — especially when the underlying business is still strong.

- Strategic context: Meta’s deal with Scale wasn’t simply about absorbing a competitor; it appears to be about securing talent and infrastructure while allowing Scale to continue operating. This kind of structure raises questions about how modern tech acquisitions and partnerships are being handled.

What to watch

- Does Scale AI continue to win high-value contracts and deliver growth despite leadership changes?

- How the relationship between Meta and Scale evolves: Will further integration happen, or will they operate distinctly?

- Whether other startups in the AI ecosystem follow similar models of investment + talent acquisition + independence.

Final word

In short: what looked like a potential demise for Scale AI five months ago may turn out to be a strategic reboot—guided by the CFO’s confident public message. For your blog’s audience, this story speaks to how tech deals in 2025 aren’t just about acquisitions but complex hybrids of investment, talent migration and operational continuity.