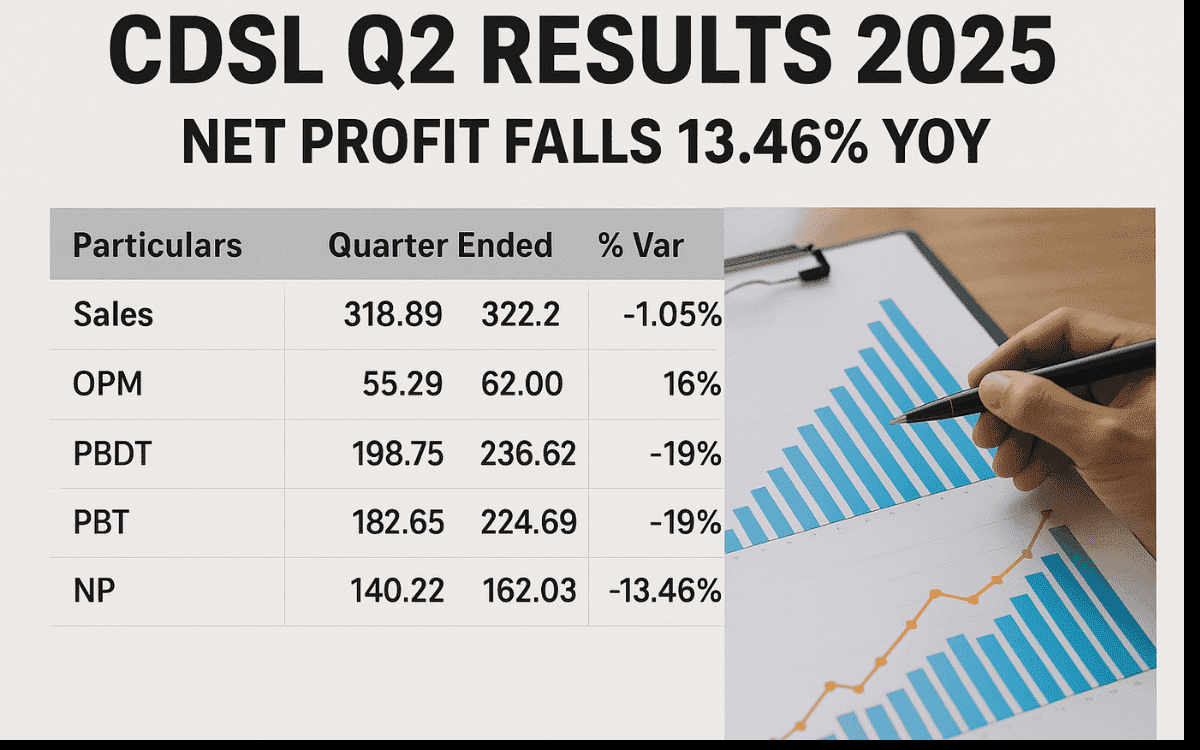

📉 CDSL Q2 Results 2025: Net Profit Drops 13.46% YoY, Margins Under Pressure Despite Stable Sales

Central Depository Services (India) Ltd (CDSL), one of India’s leading securities depositories, reported a 13.46% year-on-year (YoY) decline in consolidated net profit for the September 2025 quarter, reflecting the impact of higher operational expenses and subdued revenue growth.

According to the company’s latest financial results, net profit stood at ₹140.22 crore in Q2 FY25, compared to ₹162.03 crore recorded during the same period last year. The company’s total sales also registered a marginal dip of 1.05%, falling to ₹318.89 crore from ₹322.26 crore in the previous year’s corresponding quarter.

📊 Key Financial Highlights (Q2 FY25 vs Q2 FY24)

- Sales: ₹318.89 crore vs ₹322.26 crore ▼ 1.05%

- Operating Profit Margin (OPM): 55.29% vs 62.00% ▼

- Profit Before Depreciation & Tax (PBDT): ₹198.75 crore vs ₹236.62 crore ▼ 16%

- Profit Before Tax (PBT): ₹182.65 crore vs ₹224.69 crore ▼ 19%

- Net Profit (NP): ₹140.22 crore vs ₹162.03 crore ▼ 13.46%

The decline in profit margins can be attributed to rising costs and moderation in transaction-related revenues. Despite the fall in earnings, CDSL’s consistent market position and operational scale continue to provide stability.

💹 What’s Driving CDSL’s Performance?

Industry experts suggest that the dip in profitability is partly due to lower investor activity in the equity markets and a slowdown in new account openings during the quarter. The Operating Profit Margin dropped sharply from 62% to 55.29%, indicating higher expenses and tighter spreads on core services.

CDSL continues to benefit from a growing number of Demat accounts, supported by rising retail participation in the capital markets. However, near-term challenges such as muted trading volumes and market volatility could weigh on earnings growth in the upcoming quarters.

🏦 Outlook Ahead

Analysts believe CDSL’s long-term prospects remain robust, driven by India’s expanding retail investor base, digitization in financial markets, and the company’s strong position as a depository service provider. Continued technological integration and diversification of service offerings are expected to support growth once market activity stabilizes.

CDSL remains a key player in the Indian capital market infrastructure, catering to millions of investors and ensuring safe, digital access to securities. Investors will be closely watching the company’s performance in the coming quarters, particularly as market sentiments and volumes recover.