The German stock market turned greener on the day as the DAX index rallied further, powered by smoother inflation data out of the U.S. and shifting optimism over global trade. Investors in Frankfurt breathed a little easier — and here’s why.

What moved the market

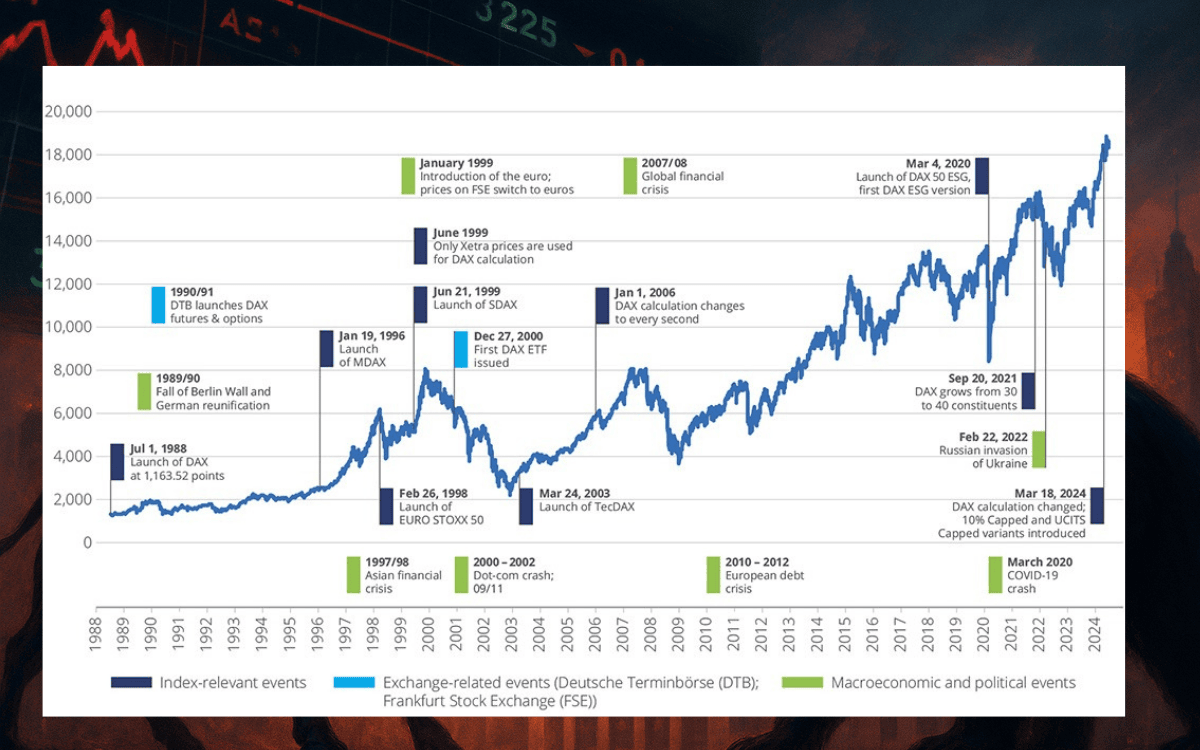

The DAX climbed by around 0.8%, pushing past the 23,700 mark in early afternoon trading. TradingView

At the same time, weaker-than-feared U.S. inflation numbers are helping stoke expectations that the Federal Reserve may lock in or even reduce interest rates. That’s lending support to risk assets globally — including German equities. TradingView

Meanwhile, trade concerns that had hovered over Europe remain in view, but the mood has shifted slightly more favourable. For example, actions to limit tariffs on pharma products under the U.S.–EU trading framework helped ease some of the tension.

Why it matters

Germany’s economy is sensitive to global headwinds — ranging from export slowdowns to tariff skirmishes. A steadying of inflation expectations in the U.S. gives European markets a breather, and that’s showing in the DAX’s performance.

Also, when the DAX outperforms like this, it often signals broader European market strength. The fact that the index is advancing despite lingering uncertainty suggests a growing confidence among investors.

The caveats

While the rally is welcome, it isn’t without risk. Inflation could bounce back, trade talks could falter or geopolitical events could throw a spanner into the works. The positive move so far reflects expectations rather than guaranteed outcomes.

Moreover, much depends on upcoming data: German industrial output, European consumer inflation, U.S. labor figures — any of these could change the narrative sharply.

What to watch next

- Upcoming German/Euro-area economic releases: any surprises here will move markets.

- U.S. inflation and job-growth data: if numbers surprise to the upside, rate-cut hopes could be derailed.

- Trade-policy updates: any renewed tariff threats or deals will matter.

- Technical break-points in the DAX: if the index holds above 23,700 and climbs toward 24,000+, momentum could build further.

Final takeaway

The DAX’s breakout today serves as a reminder that when macro conditions align — here, favourable inflation data + trade easing — markets can respond quickly. For now, the outlook is cautiously optimistic. But as always, the path ahead remains lined with potential pivots. If you’re tracking European equities or global sentiment, this move by the DAX is one to keep on your radar.