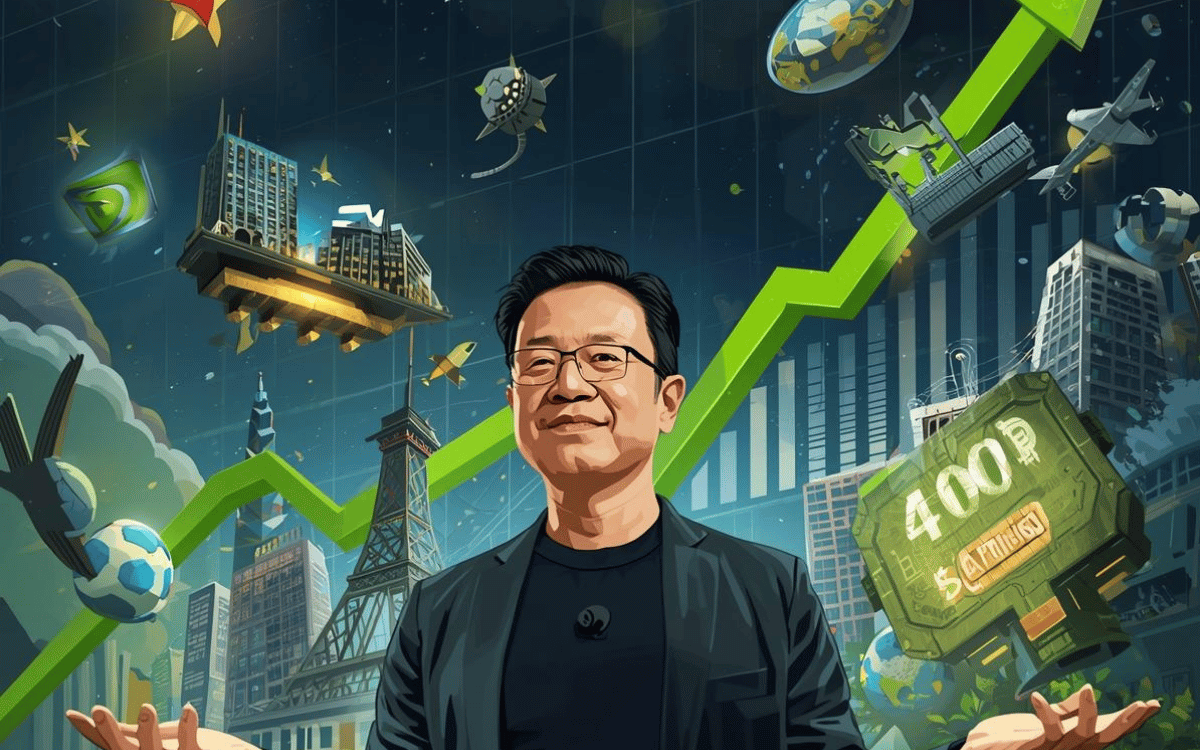

In a week that stunned Wall Street, **Nvidia Corporation added nearly $400 billion to its market value — largely driven by a flurry of strategic deals orchestrated by CEO Jensen Huang. Bloomberg+2The Times of India+2

The landmark week began with Nvidia’s inaugural developers conference in Washington, followed by Huang appearing in South Korea where he sealed major partnerships with the likes of Nokia Oyj, Uber Technologies Inc. and Eli Lilly and Company. Bloomberg+1 Collectively, these moves underscore Nvidia’s transition from a chipmaker to an AI-powered ecosystem powerhouse.

📌 The Deal-Driven Surge

Each partnership signals Nvidia’s push into new domains beyond traditional GPUs. In telecom, with Nokia; in autonomous mobility, with Uber; and in healthcare, with Eli Lilly — Huang is positioning Nvidia’s specialised chips at the heart of diverse infrastructure. When bundled with their core data centre strength, the narrative became clear: Nvidia isn’t just scaling, it’s diversifying. Bloomberg+1

The result? A valuation that touched $5 trillion, making Nvidia one of the few—if not the first—companies to crack that milestone. The Washington Post+1

🔍 Why Investors Are Buying In

Analysts point to several reasons behind the frenzy:

- Strategic breadth: Nvidia’s deals span chips, AI infrastructure and vertical use cases.

- Regulatory tailwinds: With the U.S. and other governments investing heavily in AI, Nvidia is reaping the benefit of policy shifts. The Washington Post

- Market positioning: As AI accelerates, Nvidia sits at the centre of that wave — giving it the aura of “the safe high-growth tech bet”.

⚠️ Risks Still Linger

Despite the hype, risks remain. Integration of multiple partners and sectors isn’t easy, and the sheer scale of expectation means anything less than stellar execution could spook investors. Regulatory scrutiny of AI and chip export rules could also put pressure on the momentum.

🧭 The Bigger Picture

This week’s rally isn’t just about a chip stock soaring — it’s a symbol of how companies are redefining themselves for the AI era. Huang’s bold deal spree signals that Nvidia sees its future as more than raw hardware: it’s the engine powering tomorrow’s intelligent systems.

For investors and tech watchers alike, the takeaway is clear: Nvidia isn’t reacting to the AI revolution — it’s shaping it. And in doing so, it revealed just how much value that positioning can unlock.